Max Simple Plan Contribution 2024. Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

The simple ira contribution limit for employees in 2024 is $16,000. To account for the increase, you may have to reevaluate your budget.

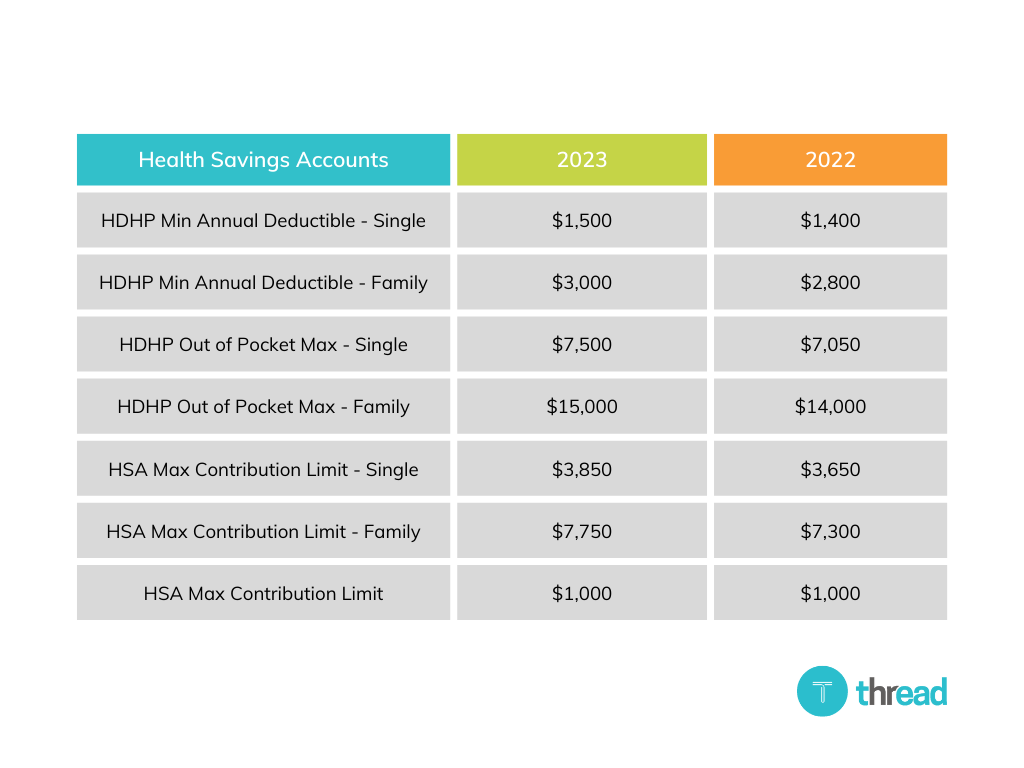

2024 Health Savings Account (Hsa) Contribution.

The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023).

Participants In Simple 401(K) And Simple Ira Plans Can Take Advantage Of An Increased Deferral Limit Of $17,600 (I.e., 110% Of The $16,000 Annual Limit) If Their.

For employees, the maximum contribution limit for 2024 is $16,000.

The Simple Ira Contribution Limit For 2024 Is $16,000.

Images References :

Source: dorrieqletizia.pages.dev

Source: dorrieqletizia.pages.dev

Simple Ira Maximum Contributions 2024 Nerti Yoshiko, To account for the increase, you may have to reevaluate your budget. You can make 2024 ira contributions until the.

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2024 Sandy Cornelia, 401 (k) and ira contribution limits are expected to increase by $500 for 2024. Like both of these plans, the simple ira is subject to annual contribution limits.

Source: isabellewaddy.pages.dev

Source: isabellewaddy.pages.dev

2024 Max Employee 401k Contribution Cari Marsha, For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. The 2024 simple ira contribution limit for employees is $16,000.

Source: isabellewaddy.pages.dev

Source: isabellewaddy.pages.dev

2024 Max Employee 401k Contribution Cari Marsha, To account for the increase, you may have to reevaluate your budget. For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, For 2024, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2023. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

Source: socialk.com

Source: socialk.com

Annual Retirement Plan Contribution Limits For 2023 Social(K), Salary reduction contribution up to $16,000 ($19,500 if age 50 or over) 5. Those numbers increase to $16,000 and $19,500 in 2024.

Source: www.usatoday.com

Source: www.usatoday.com

SIMPLE IRA Contribution Limits for 2024, For tax years starting in 2024, an employer may make uniform additional contributions for each simple plan employee to. To account for the increase, you may have to reevaluate your budget.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, Like both of these plans, the simple ira is subject to annual contribution limits. The limits used to define a “highly compensated.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The annual employee contribution limit for a simple ira is $16,000 in 2024 (an increase from $15,500 in 2023). To account for the increase, you may have to reevaluate your budget.

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2024 Sandy Cornelia, The 2024 simple ira contribution limit for employees is $16,000. The simple ira and simple 401(k) contribution limits will increase from $15,500 in 2023 to $16,000 in 2024.

Those Numbers Increase To $16,000 And $19,500 In 2024.

2024 health savings account (hsa) contribution.

The Limits Used To Define A “Highly Compensated.

Combined employee & employer contribution limit: