Fed Fomc Meeting March 2024 Agenda. Moderated discussion with kai ryssdal. During the march 2024 fed fomc meeting, the chair of the federal reserve emphasised that the fed remains “fully committed” to achieving its 2% inflation but at this point, he does not think it is appropriate to reduce rates until the fomc is confident that “inflation is moving down sustainably” toward 2%.

Fomc meeting today march 2024 outcome: More insight on interest rates, housing data and.

We Believe At Least Two Fed Officials Will Adjust Their View From Three Rate Cuts To Two, Favoring A Fed Funds Rate At 4.88% In Q4 2024.

Stocks and treasuries rallied as traders grew increasingly confident the fed will start lowering interest rates in june.

Moderated Discussion With Kai Ryssdal.

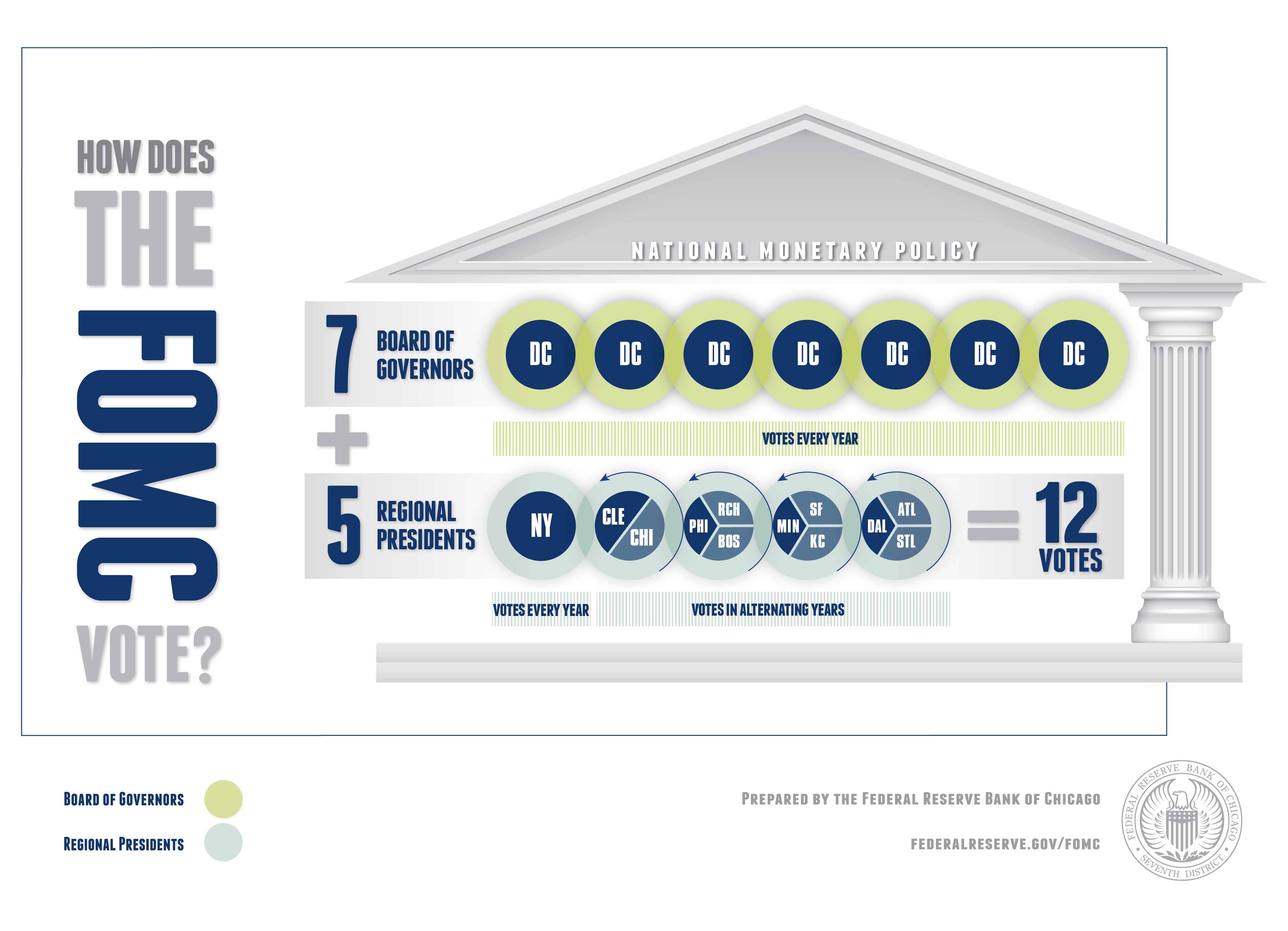

You can learn more about the fomc.

Fed Fomc Meeting March 2024 Agenda Images References :

Source: ainsleywmommy.pages.dev

Source: ainsleywmommy.pages.dev

Fomc Meeting March 2024 Time Anne Maisie, We believe at least two fed officials will adjust their view from three rate cuts to two, favoring a fed funds rate at 4.88% in q4 2024. You can learn more about the fomc.

Source: wilhelminewdiane.pages.dev

Source: wilhelminewdiane.pages.dev

When Is Fed Meeting March 2024 Twila Ingeberg, The federal open market committee (fomc) announced on march 20 that it would maintain its policy rate in a range of 5.25% to 5.5%. We believe at least two fed officials will adjust their view from three rate cuts to two, favoring a fed funds rate at 4.88% in q4 2024.

Source: knowinsiders.com

Source: knowinsiders.com

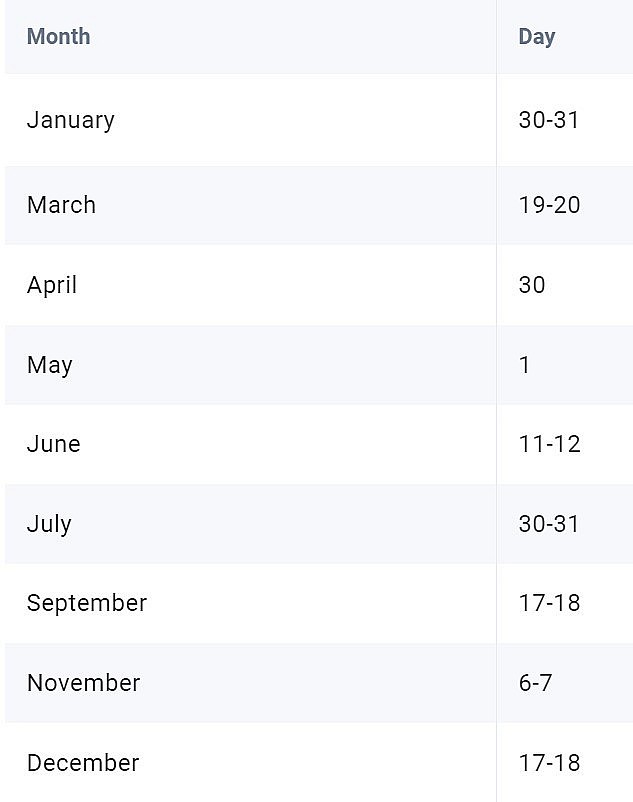

2024 FED/FOMC Meeting Calendar Full List of Dates, When to Cut, The federal open market committee, or fomc, is the arm of the federal reserve responsible for setting monetary policy. When the fed makes changes to the federal funds rate, it can greatly impact different banking products, like savings accounts, loans, mortgages, and credit cards.

Source: knowinsiders.com

Source: knowinsiders.com

2024 FED/FOMC Meeting Calendar Full List of Dates, When to Cut, These meetings are pivotal as they determine the federal funds rate,. Fomc meeting today march 2024 outcome:

Source: ninnettawtyne.pages.dev

Source: ninnettawtyne.pages.dev

Fomc Meetings 2024 March 22 Kare Sandra, Eight meeting dates in 2024. It also released new projections that.

Source: salleewjoana.pages.dev

Source: salleewjoana.pages.dev

Fomc Meeting Schedule 2024 Calendar Dates Sella Sophronia, The federal reserve system is the central bank of the united states. The federal reserve held its key interest rate steady wednesday for the fifth consecutive meeting, as the central bank awaits more data to determine when to cut rates.

Source: cassandrazpoppy.pages.dev

Source: cassandrazpoppy.pages.dev

Fomc 2024 Meeting Schedule michelin carte, These meetings are pivotal as they determine the federal funds rate,. The current target range is.

Source: vevaycristen.pages.dev

Source: vevaycristen.pages.dev

Fed Fomc Meeting 2024 Glen Philly, We believe at least two fed officials will adjust their view from three rate cuts to two, favoring a fed funds rate at 4.88% in q4 2024. Stocks and treasuries rallied as traders grew increasingly confident the fed will start lowering interest rates in june.

Source: knowinsiders.com

Source: knowinsiders.com

2024 FED/FOMC Meeting Calendar Full List of Dates, When to Cut, The federal reserve held its key interest rate steady wednesday for the fifth consecutive meeting, as the central bank awaits more data to determine when to cut rates. The federal open market committee (fomc) announced on march 20 that it would maintain its policy rate in a range of 5.25% to 5.5%.

Source: salleewjoana.pages.dev

Source: salleewjoana.pages.dev

Fomc Meeting Schedule 2024 Calendar Dates Sella Sophronia, The march decision marks the fifth consecutive meeting at which the federal reserve (fed) has opted to hold interest rates steady. Global markets, including those in asia, were on edge as.

We Believe At Least Two Fed Officials Will Adjust Their View From Three Rate Cuts To Two, Favoring A Fed Funds Rate At 4.88% In Q4 2024.

The federal reserve system is the central bank of the united states.

When The Fed Makes Changes To The Federal Funds Rate, It Can Greatly Impact Different Banking Products, Like Savings Accounts, Loans, Mortgages, And Credit Cards.

The march decision marks the fifth consecutive meeting at which the federal reserve (fed) has opted to hold interest rates steady.

Posted in 2024