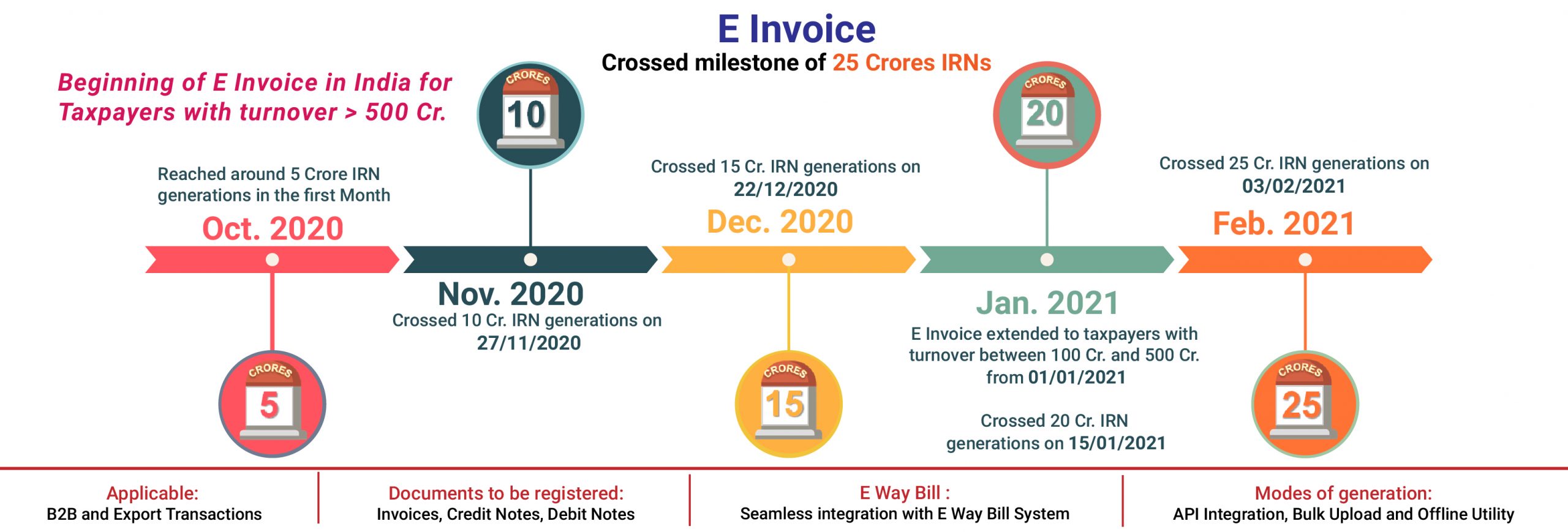

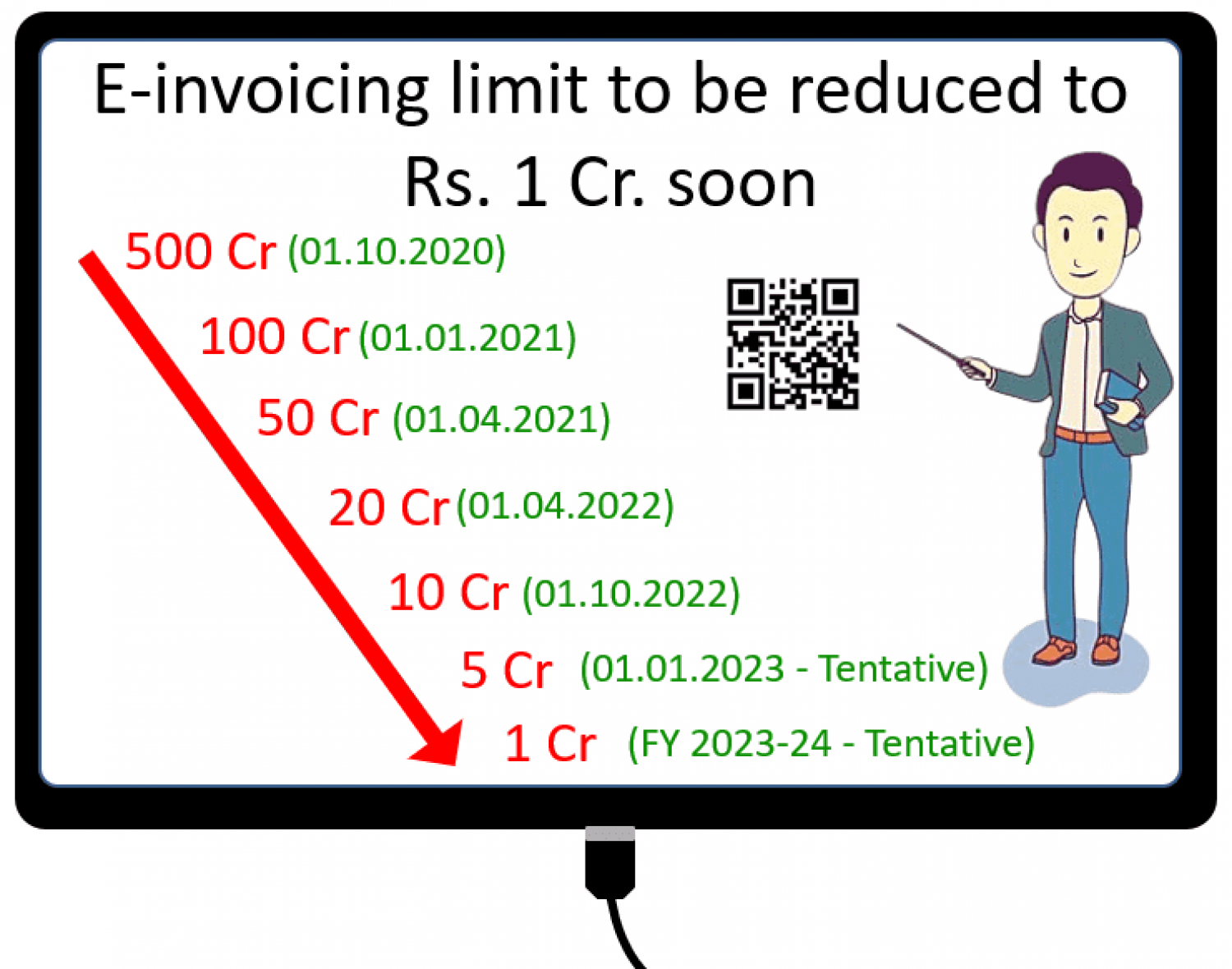

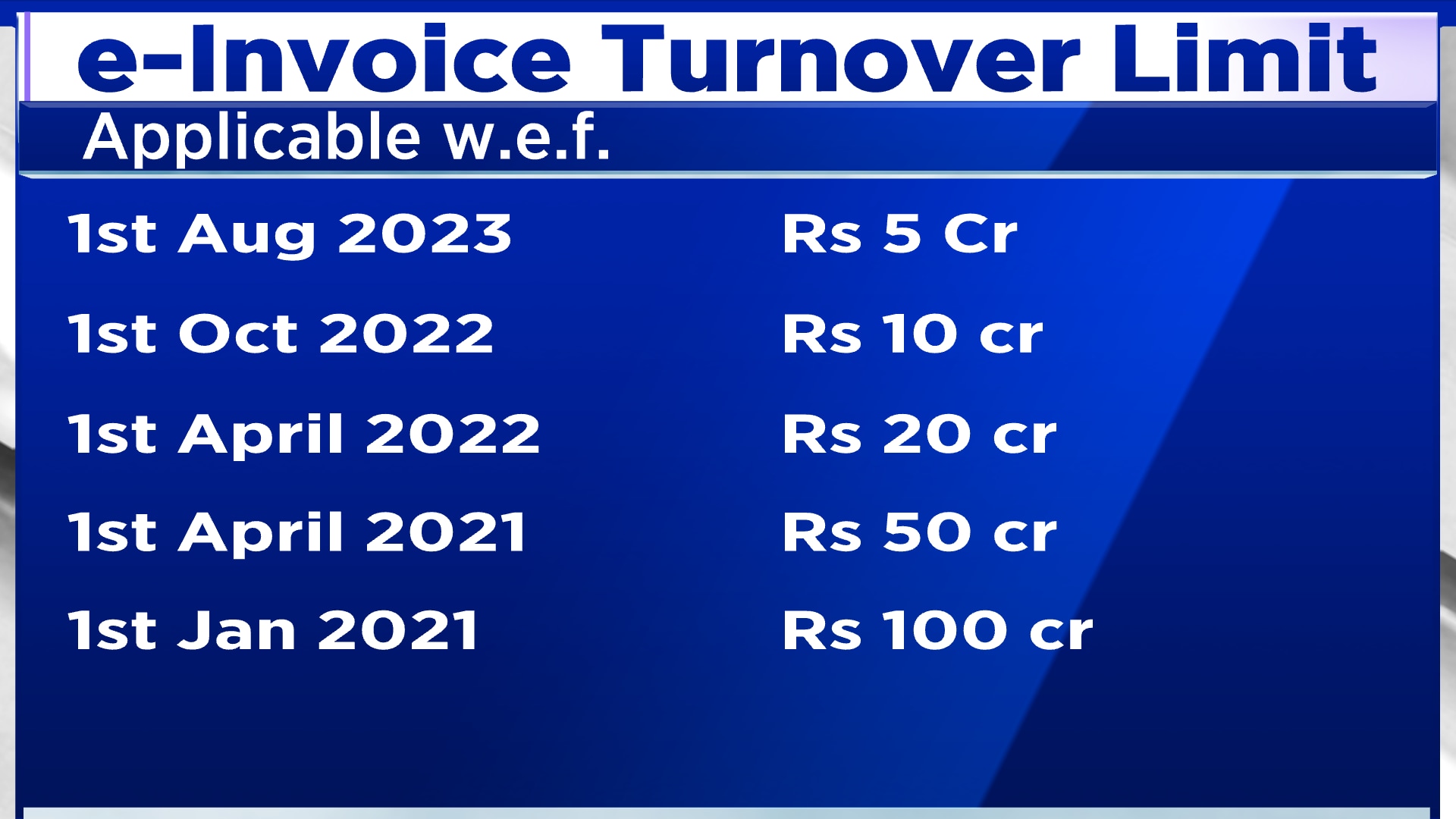

E Invoice Applicability Turnover 2024. Businesses having a turnover of five crores or more would. The central board of indirect taxes & custom (cbic) has lowered the.

The gst council had decided to implement electronic invoice in a phased manner. As per the notification no.

Read The Article To Know Steps For Readiness And Solutions.

If your aggregate turnover does not exceed rs.5 cr in any of the previous period during gst era, but expected to exceed turnover limit of rs.5 cr.

This Threshold Was Then Lowered To.

As per the notification no.

As Per The Gst Notification 17/2022, From October 1, 2022.

Images References :

Source: carajput.com

Source: carajput.com

Applicability of EInvoice Framework for GST RJA, Read the article to know steps for readiness and solutions. The central board of indirect taxes and customs (cbic) released its first notification of the new.

Source: carajput.com

Source: carajput.com

Einvoicing threshold limit, GST Einvoicing limit, Einvoicing, From 1st october 2022, the limit. As per the gst notification 17/2022, from october 1, 2022.

Source: www.youtube.com

Source: www.youtube.com

New Turnover Limit for e invoicing from 1St Aug 2023 New GST Invoice, This threshold was then lowered to. Earlier, the gst network has issued an advisory implementing a time limit of 7 days to report invoices and documents to irp from 1st may 2023.

Source: www.udyamica.com

Source: www.udyamica.com

GST Einvoice is mandatory for taxpayers with turnover exceeding 20Cr, If your aggregate turnover does not exceed rs.5 cr in any of the previous period during gst era, but expected to exceed turnover limit of rs.5 cr. This threshold was then lowered to.

Source: www.udyamica.com

Source: www.udyamica.com

GST Einvoice is mandatory for taxpayers with turnover exceeding 5 Cr, If your aggregate turnover does not exceed rs.5 cr in any of the previous period during gst era, but expected to exceed turnover limit of rs.5 cr. The central board of indirect taxes & custom (cbic) has lowered the.

Source: www.theindianbytes.in

Source: www.theindianbytes.in

Einvoice Mandatory For Turnover 5 Cr New Changes Impact Your, This threshold was then lowered to. If your aggregate turnover does not exceed rs.5 cr in any of the previous period during gst era, but expected to exceed turnover limit of rs.5 cr.

Source: www.youtube.com

Source: www.youtube.com

EInvoice Mandatory for Turnover Exceeds 5 Crores 1st January 2023 से, Now let’s consider key scenarios applicable. From 1st october 2022, the limit.

Source: mybillbook.in

Source: mybillbook.in

Mandatory Einvoicing for Companies With Turnover ₹10 Crore, The central board of indirect taxes and customs (cbic) released its first notification of the new. The central board of indirect taxes (cbic) announced notification no.

Source: www.youtube.com

Source: www.youtube.com

E invoicing limit Reduce E Invoicing for 5 Crore turnover under GST, The central board of indirect taxes (cbic) announced notification no. This threshold was then lowered to.

Source: www.cnbctv18.com

Source: www.cnbctv18.com

Mandatory einvoice from August 1 for GST taxpayers with turnover, The central board of indirect taxes and customs (cbic) released its first notification of the new. If your aggregate turnover does not exceed rs.5 cr in any of the previous period during gst era, but expected to exceed turnover limit of rs.5 cr.

This Threshold Was Then Lowered To.

The gst council had decided to implement electronic invoice in a phased manner.

Earlier, The Gst Network Has Issued An Advisory Implementing A Time Limit Of 7 Days To Report Invoices And Documents To Irp From 1St May 2023.

As per the notification no.